How to Send Money Using Account and Routing Number

It is quite easy to transfer money from one person to another nowadays. Many types of money transfers are available when you need to transfer money quickly to another bank or credit union account.

Technology has made it easier than ever to send money to someone else. You can manage your account online at banks, credit unions, as well as other types of financial institutions. You can set up your online account on your phone or computer, and then you’re good to go.

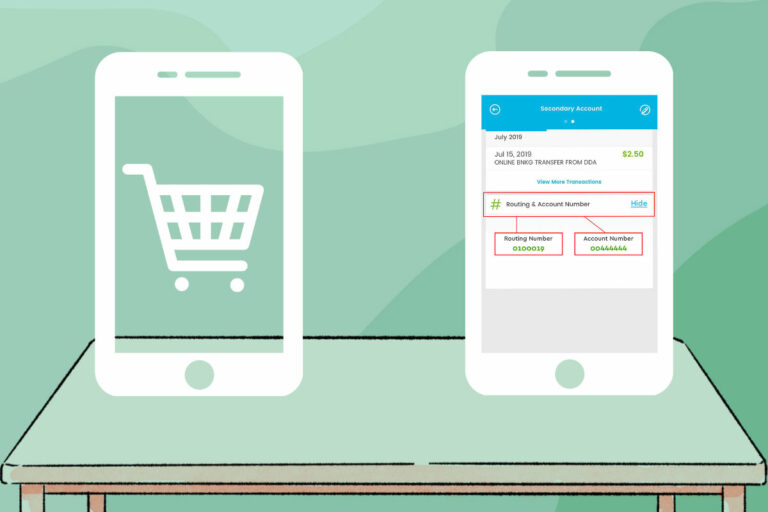

If you want to send money from your checking account to another bank account while doing online shopping, you will almost certainly be asked to provide the account and routing number details. So, How to transfer money using the routing number and account number? Let’s see what happens!

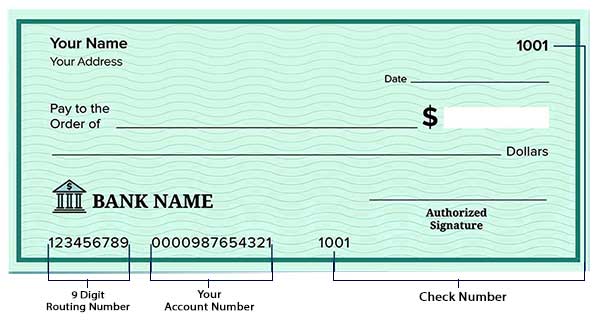

Find Your bank Account Number on a Check

The account number is also written on a check, along with the routing number. Account numbers are the second batch of digits on the bottom of the check following the routing number. Your account number is typically 10 to 12 digits in length, and it is unique to you.

You can also discover your account number on your monthly statement, whether it’s a printed or an electronic version. In addition, you can access your account number by logging into your online account. An embossed or laser-printed account number appears on the front of most debit cards. When transferring funds to another person’s account at the same financial institution, you’ll need their account number.

What does a routing number mean?

Surely you’re familiar that when you create an account with a bank or credit union, you’re given a personal account number. When you make a deposit, the money goes directly into your designated account since your account number separates you from everyone else.

Now, we’re back at the route number. A routing number, on the other hand, is a nine-digit identifier that distinguishes one bank from the others. Routing numbers are unique to each financial institution, and they serve as a record of where you first started your account. As a result, different branches of the same bank may use different routing numbers.

The number is the first set of numbers at the bottom of your check, immediately to the left of the first group of numbers. Alternatively, you may see the routing numbers for your bank or credit union on their website. You may also receive the numbers by calling your customer service department.

What does the term ACH stand for, and how does it work?

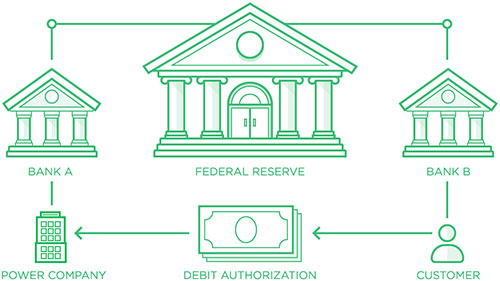

Automated Clearing House is referred to as ACH.1 In the United States, it is an electronic money transfer mechanism used by banking institutions. “Direct payments” is another term for ACH transactions. They make it simple to transfer money between bank and credit union accounts without the need for credit card networks, paper checks, wire transfers, or cash.

There are just a few steps involved in an ACH transfer. Even if you don’t realize it, you may be using ACH transactions with your bank institution. The following is a list of ACH transfer examples.

ACH transfers can be divided into two categories. A credit or a debit might be included. When funds are sent to your account via an ACH transfer, this is referred to as an ACH credit. For an ACH credit transfer, you must provide the account number and the institution’s routing number.

To put it another way, when you say “ACH debit,” you’re talking about an electronic transfer in which funds are sent from your bank to, say, the account of your water or internet service provider. Payment may be set up so that money is taken from your account and put into the designated account at regular intervals. To use ACH debit transfers, you’ll need the routing and account numbers provided by your service provider.

You may send money to people in other countries through ACH transactions. You should also keep in mind that foreign ACHs are more expensive than local ACHs. It takes several days to complete all ACH transfers. The transaction takes longer on the weekend than it does during the week.

Read also: Can You Send Money to Yourself with PayPal Credit?

How to Send Money Using Account and Routing Number?

You can send money out of your account by using your routing as well as account numbers. When you send money from your bank to another bank, this is what will happen. You can send money to other people electronically with wire transfers or ACH. Using the routing number and account number, you can do the following to send money.

1] Log in to your online profile.

2] Go to the section about transferring cash.

3] Enter the information about the recipient, including the account and routing numbers.

4] Type the amount you want to send.

5] Press the “Send” button.

6] Check the details of the transfer.

7] Use your PIN, Touch ID, or any of the other best ways to authorize.

If you use wire transfers, the money should get to the right people on the same business day. If you use ACH transfers, the money should get to the right people in a few days.

How to Transfer Money Using Routing Number and Account Number

There are several ways one can send money using an account and routing number. They include the following.

1] Bank to Bank Money Transfer

When we don’t use mobile wallets or apps, we usually need to send money through one debit card to another bank account or bank to bank. In this case, you can go to the bank branch and do the transfer in person.

Even if there are any additional fees, you won’t have to supply anything other than your account number. Most people over 60 use bank-to-bank money transfers because it is one of the easiest ways to send money from one bank account to another.

Most of the time, a wire transfer is used to send money from one bank account to another.

- Enter important information like the name of the recipient, their account number, and the routing number.

- Then, the transaction would happen on the same day.

- Wait a few days for the money to show up in the account of the person you sent it to.

Withdrawing cash from an ATM is another way to send money in a similar way. For this, you would also need to give your account number.

- Go to a nearby place and take money out of an ATM.

- Go to the bank to put the money in the account of the recipient.

2] Money Transfer Using a Cheque

You can send money from one bank account to another by writing a check. The other bank will ask for money from the other account using the routing and account numbers on your check. When you write a check, you should have enough money in your bank account for the transfer to go through. If not, the check will be returned.

Remember that if you tend to bounce checks, it will be hard for you to open new bank accounts or credit union accounts once your name is in the ChexSystems. Your information can stay in ChexSystems for up to five years.

You can use the following format when writing a check:

3] Depositing Directly

Direct deposit is the process of putting money from the account into someone else’s account. You need both the routing number and the recipient’s account number. Direct deposit is an option for employers that want to pay their workers.

The only bad thing about direct deposit is that you can’t send money to another country with it. Also, the money takes longer to get to the right bank account, which is not the case with account-to-account transfers through a credit union or a mobile money wallet.

4] Using Money Order

A money order can be cashed or put into a bank account, just like a check. When you send money with a money order, you buy a piece of paper with information about how much money you want to send. It has two places to sign, one for you and one for the person you’re giving it to.

You can use a check or a debit card to pay for the money order. A money order can also be purchased using your account and routing details from another bank. Money orders can be used both in the U.S. and abroad. Here’s what you need to do to write a money order.

5] Bank to Prepaid Card Money Transfer

It is possible to send money from one bank account to a prepaid card, and the other way around. Payment cards that enable you to purchase products and services online are known as pre-paid cards. Your prepaid card can be reloaded at a bank or credit union. There is a distinct account and routing number for a prepaid debit card since it is owned by a different financial institution.

So, if you want to transfer money out of your checking account, you will have to sign in to your account online and get the routing and account numbers. Keep in mind that you’ll need to follow the same steps as when you transfer money from a bank account to the next account at a different bank. In the same way, you can transfer money from an account tied to a prepaid debit card to a bank account.

6] Bill Pay with Account and Routing Number

Set up a direct transfer to pay your utility bills like electricity or internet service by getting the bank routing and account numbers of the service provider’s bank account. To avoid forgetting to pay your expenses, you should set up a direct transfer. If you don’t pay your bills on time, some service providers may even penalize you.

7] Withdrawing Cash

Account and routing numbers can also be used to transfer money from a virtual or online bank account to a bank account. The receiving bank account’s routing and account numbers are required. You can withdraw money from an ATM or a bank account as soon as the money is in the target account. You will also be able to use the two sets of digits to get cash by paying your monthly expenses.

Read also: Can You Send Money from Zelle to Cash App in 2023?

Method To Withdraw Money Using Account Number and Routing Number

Withdrawing money is simple if you have enough money in your bank account to do it. Overdrafts can occur if you make too many withdrawals. Even if a bank has substantial overdraft limits, extra fees may apply. So, let’s take a closer look.

It’s best to start the transfer a few days before the deadline if you’re paying bills this way. This is because ACH may take up to five days to complete, so keep this in mind when placing your order.

How to withdraw funds using a routing and account number?

I said before that you can withdraw money from the account by using your routing and account numbers. When paying your monthly expenses, the following is a technique to withdraw money using routing and account numbers.

Via your account and routing details, you will still have withdrawn your money. Don’t forget that you could have taken money out of your account number to pay for your bill. However, can someone use my bank account and routing number to withdraw money?

Withdrawing money from someone else’s account and routing number is tricky. However, fraudsters may be able to utilize the two sets of numbers to erase your account. You should always be sure to share the numbers with those that you can trust.

I know you’re wondering whether these numbers can be used to steal your money. However, if they also use your sign, they can submit a check to your bank and request money.

How is it possible to transfer money instantly using routing and account numbers?

It takes too long for the money to appear in the recipient’s account when using direct deposit or ACH transfers. Wire transfers, on the other hand, can have your money to the recipient’s bank in as little as 24 hours.

You should be aware that most wire transactions are final and that you should use extreme caution when inputting your account information.

Can I do Transactions Only by Knowing My Bank Account Number?

In today’s world, opening a bank account online is a simple process. Online checking accounts do not need an initial deposit or a credit check to be opened. Once you’ve received your account number, you may begin making a variety of purchases and payments. However, making a purchase requires more than just your account number. Your account would be vulnerable if anybody could get their hands on enough money to do so.

To access money in an online account, you must provide your login details. A password, PIN, Touch ID, or Face Unlock is normally required when establishing an online account for the very first time. In addition to sending money, paying bills, and checking your balance, you may also log in to your account and do all of these things.

What’s the difference between an account number and the routing number?

You could be wondering what’s different between the two numbers. It’s important to note that a routing number and an account number are two wholly different things altogether.

Routing numbers are used to differentiate one bank from the others. Transferring funds from one bank to another is made easier with this feature. A bank account number identifies you from other bank clients. Each and every one of your customers needs an account number.

As a second point, the digits in a routing number are nine. It’s the first set of numbers from the left on the bottom of your check, as I explained previously. There are 10-12 digits in the account number, which falls in the center of 12 digits.

Read also: How To Transfer Money from Revolut to My Bank Account?

Why Would Someone Need Routing And Account Number?

There are several reasons why you’ll need a routing and bank account. Here are the reasons you need both sets of numbers.

1) When someone needs money, send it to your bank account.

Using a routing and account number enables you to send money to another person when you make a direct deposit, wire transfer, or ACH transaction. If you’re sending money to an account at the same bank, all you need is the account number of the person you’re sending the money to.

2) If you use bill pay or buy something online

When you pay a bill online, you have to send money from your bank account to the recipient’s bank account. To send money to a service provider’s account, you need their account number and routing number.

3) When you use a financial app to connect your account to it.

You can transfer money from a financial app to your bank account. But you have to connect them to your bank account. In this case, you’ll need your account and routing numbers. In the same way, you need your routing and account numbers when you add a bank account to a financial app so that it can help you pay for transactions.

4) If you write a check

When you write a check to another bank, that bank will use your bank account and routing number to take money out of your account and put it in the account of the person you are paying. That’s why I said before that someone can ask your bank for a check if they know your routing number, account number, and physical address.

Can you send funds with just a routing number?

You can’t send the money to someone with just the routing number. It must be used with your account number. In the same way, you can’t just use someone’s account number to send money to their bank account. A routing number isn’t enough to transfer money to someone if you don’t know their bank account number.

Choosing The Right Bank For Money Transfers

The following factors might help you choose which bank is the most dependable when it comes to credit card transactions and remittances.

1] Account Without Monthly Fee

If possible, use an account that does not charge a monthly fee. One-time deposit accounts are preferable to those that incur a minimal monthly fee.

Some bank accounts carry a monthly fee, but you may avoid it in some cases.

Keeping your account balance over a specified threshold, for example. Incentives like these encourage consumers to put their money where their mouth is.

2] There is no Minimum Balance Requirement

At the same time, it is possible to establish a bank account without a minimum balance. This is, in fact, the favored method. When you retain a minimum amount on your account, the funds are locked up and cannot be accessed, which is a drawback.

3] Online and Mobile App Access

Nowadays, having online banking and smartphone access is really convenient. When it comes to money transfers, no one has the time to go to the bank. Using a banking app is as simple as sitting down in front of your computer or pulling out your smartphone.

4] No ATM Fees

It’s always a good idea to seek a bank account that doesn’t impose fees when you withdraw funds. As an additional consideration, you should look for a bank with a broad ATM network that you can quickly use.

Dangers Of Leaking Account Or Routing Numbers

It is widely accepted that money transfers are secure since you are obliged to provide your bank account information and routing number.

However, in order to protect yourself against scams, we advise not disclosing personal information to just anybody.

Keep in mind that your PIN is significantly more sensitive and confidential than your account or routing numbers and that you should never share it.

Your account or routing number may only be changed by closing your current one, then opening another one elsewhere. However, if you feel that your ATM PIN has been compromised, you should change it immediately.

Hackers can take advantage of your personal information if precautions aren’t taken. It’s a good thing that most trustworthy banks provide excellent customer help for successful transfers of money.

Read also: Transfer Money From PayPal To Revolut: Step By Step Guide

Frequently Ask Questions

The Summing Up

No matter what the reason is, most people have to transfer cash to a family member, friend, or someone else at some point. You can send and receive money at banks and credit unions both in person and through their websites. The account number is only necessary if you’re moving money from one bank or credit union to another.

For any money transfer to another bank account, you need the routing number and the account number. Someone can steal your bank account information, like your routing and account numbers.

- https://www.consumerfinance.gov/ask-cfpb/what-is-an-ach-en-1065/ ↩︎

![Can you Combine Visa Gift Cards? [Answered] 11 Can you Combine Visa Gift Cards? [Answered]](https://etransfermoney.com/wp-content/uploads/2022/10/Can-I-combine-visa-gift-cards.jpg)

![Does Walmart Accept American Express? [Answered] 14 Does Walmart Accept American Express? [Answered]](https://etransfermoney.com/wp-content/uploads/2022/09/Does-Walmart-Accept-American-Express-768x548.jpg)