40 Snap Finance Stores That Accept Buy Now Pay Later

Are you fed up living with bad credit and struggling to make ends meet? Many say bad credit lasts forever, but we say Snap finance stores can fix it. Whether you have zero credit or are stressed with bad credit, Snap Finance can come to the rescue.

Oh, wait! The term “Snap Finance” may be new to you then. Snap Finance is a financial solution for those looking to make purchases but are facing difficulties in doing so. A fintech company called Snap Finance offers this kind of solution.

They say, buy now and pay later. Over 200,000 retailers across the United States are offering this lease-to-purchase financing solution. Though it’s a simple way of financing, many say it costs somewhat high due to the interest.

The best part is if you pay for your purchases within 100 days, you won’t have to pay interest. Simply put, it’s a boon for those with no credit or bad credit. This article will guide you if you want to try snap finance for the first time.

What is Snap Finance?

Snap Finance is a company headquartered in Salt Lake City, Utah, founded in 2011. They provide consumer and merchandise financing to e-commerce and “brick-and-mortar” merchants.

They can provide instant lease approvals up to $5000 with an 80% approval rate. You can purchase anything from jewelry to furniture to electronics with the lease amount. You can take the goods you bought home immediately.

It is hassle-free. Since your purchase is considered a lease, you can repay the lease money over 12 months. You’ll directly own the goods at the end of the lease term. This is why it is sometimes called a lease-to-own purchase.

Why Choose Snap Finance?

The main goal of snap finance is to make a person capable of purchasing goods. It funds people without credit, minimum credit, bankruptcy, etc. There are a few reasons why choosing snap finance is best to start with nothing:

- You can snap finance shop online at a store instead of visiting a lease-to-own store. Here, your credit situation doesn’t matter.

- You’ll get an unparalleled choice of financing with maximum flexibility.

- Unlike a bank lease, it allows you to borrow goods even if you have no credit or bad credit.

- Applying for a lease is simple and direct to the point.

- Same-day application and approval.

- Snap Finance offers lease-to-own financing on various products, including furniture, electronics, jewelry, etc.

- When the lease term ends, you’ll own your purchased items.

- While many lenders ask for collateral as security, Snap Finance doesn’t require any from you as collateral.

- 100-day payment options to save more money

Snap Finance Pros & Cons

PROS

CONS

Snap Finance Requirements for Approval

Snap finance has some minimum requirements to get approved. You must have the following requirements to be eligible for snap financing.

- 18 years old or older to apply for Snap finance

- A steady source of income throughout the lease period

- Must hold an active checking amount

- A valid email address or contact number

Before you apply for snap finance, make sure you read the declarations of the contract thoroughly. Check the approved amount, the amount to pay during the lease term, due dates, etc. Also, understand the terms and conditions of the contract.

How Does Snap Finance Work?

The first step to snap finance is to apply for lease financing. However, there is a process to apply for Snap Finance. It is simple and straight to the point. If you can meet the requirements, you are good to get rolling.

1) Apply Online

You can make the application for snap finance online at snapfinance.com. There is a form to fill out. You must give your name, social security number, driver’s license number, employment information, bank account details, etc.

It takes a few minutes to fill out the form. Snap Finance will then consider your credit situation. If you are lucky enough, your application will get approved right after applying. Then, your applied lease amount will be specified with the interest rate.

2) Choose a Store

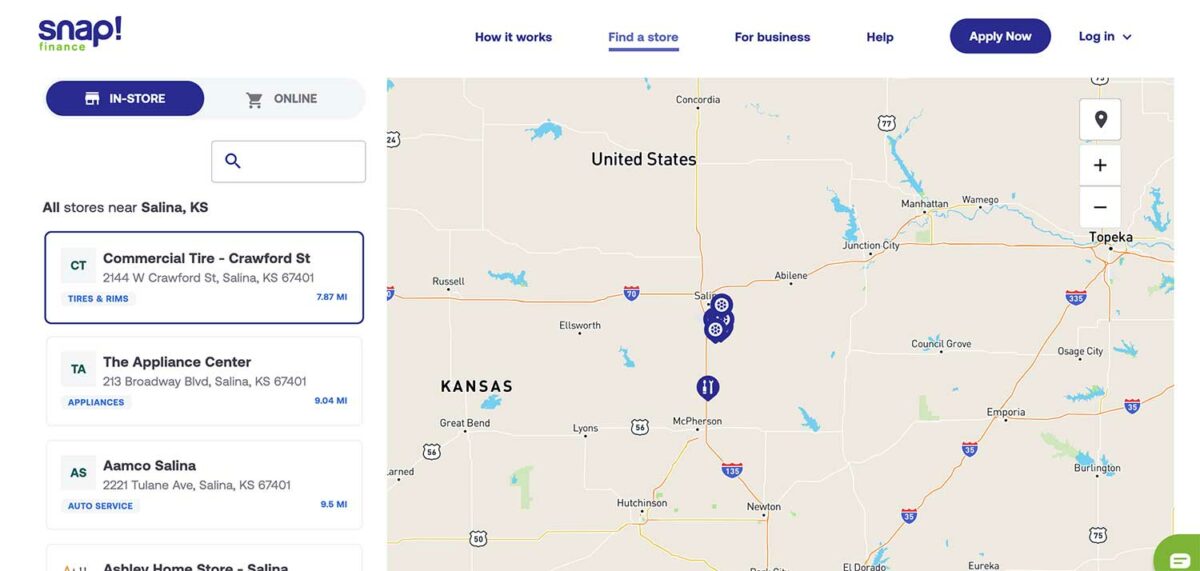

You’ll get a virtual card on the contact number you’ve provided when you get approved. Now start looking for snap finance stores that accept lease financing. Based on your permitted credit limit, you can search for items up to $5000.

Snap Finance has a large number of stores all over the USA. Search what stores accept Snap Finance near you. You can try the snap finance store locator tool on their website. Then, use the virtual card to lease any items you want.

3) Start Purchasing

After you have chosen the stores and items, it’s time to make a purchase. Show your virtual card to the cashier of the store. Allow the cashier to log in with your card number. Finally, the cost of the purchased item will be deducted from your approved credit amount.

See, it’s as simple as that!

Where Can I Use Snap Finance?

You can use Snap Finance at more than 200000 stores and online merchants across the United States. Snap Finance is a one-stop solution for people who are financially stressed.

However, you can now shop from the Snap Finance stores and pay later. You can pay for your purchased items in installments. Snapfinance online shopping is available at over 1,000 retailers and brands.

So, you get countless options for financing. You will surely find many stores near you if you start looking. Search with “snap finance furniture stores near me” in the snap finance locator.

Snap Finance Stores Locator:

Use the Snap Finance store locator tool on the Snap Finance website. Then, find a store near you and apply for snap financing for the things you need. There are categories of goods in the store locator tool, including:

- Auto service

- Tire & Rims

- Furniture

- Car Audio

- Mattresses

- Jewelry

- Appliances

- Electronics

- Medical devices

- Scooters

- Home décor

- Lawn & Garden

- Musical instruments and others

What Stores Accept Snap Finance?

A vast number of stores across the USA accept SNAP finance. You’ll find a store near you that accepts snap financing. Below we have discussed what stores accept snap finance based on the categories.

1. Furniture Stores That Accept Snap Finance

Are you on the lookout to furnish your new home? But cannot think of buying new furniture because of no credit and bad credit history? No worries, bad credit won’t stop you from buying what you want.

There are countless furniture stores with snap finance options. They can help you furnish your home at an affordable price with the best quality furniture—search snap finance furniture stores near me.

Below is a list of furniture stores that accept SNAP Finance. Choose a furniture store near you and start snap-finance online shopping now.

1] Affordable Home Store – Lease for up to 36 months in term or pay in 4 options to settle the loan within four months.

2] Big Sandy Superstore – Credit plan with no interest, low payment, no credit check, and layaway

3] Sam Levitz Furniture – Special financing options are available for those looking to build credit.

4] CB Furniture – Interest-free financing for up to 60 months

5] Today’s Home Furniture – No Credit needed financing options to fit your financing goals.

6] Walker Furniture – No interest if paid in full within 6, 9, or 12 months. They have fixed monthly payments with 9.99% APR for 60 months.

7] Zoe’s Furniture – Payments start ten days after receiving your items. Payments within 12 months with a 100-day cash payoff.

8] Welch’s furniture – 90-day payment option with no credit needed.

9] Buy-Rite Beauty – Financing for up to $5000 without a credit score needed. Payoff financing within the first 100 days of purchase. Instant approval for financing.

2. Online Jewelry Stores That Accept Snap Finance

Need to finance an engagement ring or other jewelry for the special day? Or, you may be looking to expand your jewelry collection but cannot afford to make the payment upfront.

No problem, there are many snap finance jewelry stores to make your wish come true. You don’t have to wait for savings to buy jewelry. Snap financing makes this easy for you.

Many online jewelry stores accept snap finance. You can purchase the jewelry of your liking and pay later.

1] Shyne Jewelers – It offers two great financing options through Synchrony Financial. Allows finance on the entire purchase, or you can put some money down to make affordable monthly payments.

2] Zaragoza Jewelry – A range of services including custom jewelry design, jewelry repair, jewelry test, jewelry finances, etc.

3] James Free Jewelers – Flexible Financing Program with SYNCHRONY FINANCIAL. No payment penalties and 0% APR are available for 3-month financing.

4] Vjdiamond.com – One-stop shop for jewelry freaks. Shop from a wide range of collections with a snap finance facility.

5] MiaDonna – 24 monthly payments of $46.14 USD at 9.99% APR, per $1,000 borrowed. The APR rate varies depending on the loan amount, credit applications, and terms.

6] Rogers & Hollands and Ashcroft & Oak Jewelers – No interest if paid within 6, 12, 18, or 24 months. No down payment is required.

3. Online Electronic Stores That Accept Snap Finance

When struggling with bad credit or no credit, it’s tough to think of buying electronic products. Thankfully, Snap Finance has your back. You can find a lot of electronic stores that accept Snap Finance.

This allows credit-challenged shoppers with the buying ability to get what they need. You can purchase essential electronics, from mobile accessories to vehicle speakers.

Below we’ve listed some of the best online electronic stores that accept Snap Finance.

1] Electronic Express – All types of electronics, including TVs, computers, laptops, etc., used in our daily life are available here. One of the best Snap Finance TV stores. Flexible payment option with no hidden costs. Quick approval.

2] Electrofinance.com has an accessible lease-to-own option on all electronics, including computers & Tablets, TV & Home Theater, Garage & Outdoor, Smart Phones, etc.

3] Audio Extreme – From car electronics to mobile accessories, you’ll get it all at an affordable price.

4] Big Sandy Superstore – Video and audio systems are available at a low sale price.

5] SK Customs Car Audio – This North Atlanta-based store has all the necessary products for the car. All kinds of modern gears used in the car are available here in top-notch quality.

6] Mac Star Cameras – It’s a great place for video content makers with no credit. Brand new cameras, lenses, drones, and other electronics are available with easy financing.

4. Appliance Stores That Accept Snap Finance

What turns a house into a home? Indeed, nice floors, walls, décor, or views contribute to the comfort of being at home. But, appliances play a major role in making your well-designed house a good home.

Get all the appliances for your new home with snap financing. Having no credit or bad credit isn’t an issue now. Also, you don’t have to wait months to embellish your home with the things you need the most.

Many appliance stores accept Snap Finance. From cooking range to laundry, snap finance from these stores will make it happen. You can check the following snap finance stores to get your most needed appliances.

1] Appliance TV outlet – All the appliances needed in a home are available here. It accepts Snap Finance. A processing fee is charged on the day you complete the transaction.

2] Electronic Express – 100-day payoff option with no hidden charges. Quick and easy approval. Safe and secure.

3] Big Sandy Superstore – Shop all the indoor and outdoor appliances from here. Enjoy the no-lease financing with no added charges.

5. Mattress Stores That Accept Snap Finance

It is not true that you won’t have a restful sleep if there is no money. Luckily, no credit will bother you when you shop with Snap Finance.

Buy whenever you need and pay over time. So you can sleep with peace of mind about at least one thing. There are many Snap Finance mattress stores where you can purchase your preferred size.

You can get the bed of your dream without worrying about your financial condition. The followings are a few stores where you can get your perfect bed online.

1] MattressFirm – Get better sleep for $1 first three months with 36 months of financing. Utilizes advanced technologies to make your sleep better. No credit is needed and powered by progressive leasing.

2] OrthoMattress – Find your perfect beds from their ready-made and customized beds. Easy checkout and instant approval. No interest if paid within 6, 12, 18, and 24 months. No credit check. 0% APR for 60 months.

3] Mattress Depot USA – Several financing and payment plans are available for online and in-store purchases to meet your needs. Snap finance option for credit-challenged buyers. Online and in-store applications are available.

4] Electronic Express – Purchase your dream mattress from their different categories. Accessible and flexible financing option. No credit history is required.

5] Big Sandy Superstore – Over 70 models available from 9 different brands with five advanced technology. No credit, no interest, and low payments with 100% financing approval. They allow you to try the mattress before you buy it—free delivery in locals.

6. What auto shops accept snap finance?

Auto vehicle parts and repair can be stressful and very costly. Oh, are you Thinking about how to afford the cost? Don’t worry; Snap Finance will sort the issue.

You can purchase the car tires, wheels, audio system, etc., whatever is needed, and pay over time. There are countless Snap Finance tire stores and car audio stores around you to help.

6.1. Snap Finance Car Audio Stores

1] Audio Extreme – They are car audio and mobile accessories experts. Several car audio and upgrades are available at the best prices.

2] Down 4 Sound Shop – It offers lease-to-own financing for credit-challenged shoppers. Get what you need with a 100-day interest-free facility. Credit approval for up to $5000. All other American First Finance is available.

3] SK Customs Car Audio – This North Atlanta-based One Stop Car Audio Shop includes all types of vehicle accessories. It includes car audio, video, remote start & alarms, train horns, sound processors, jeep and truck accessories, laser & radar detectors, etc.

6.2. Snap Finance Car Tire and Wheel Stores

1] Finish Line Tire & Automotive – Multiple financing options on automotive products and repairs. Your vehicle should keep running, no matter no credit or bad credit. Get up to $3000 with an 80% approval rate.

2] Coastal Moto – After their flexible layaway programs, get your wheels and pay later. You can schedule your payment plans. Above all, it’s free and flexible.

3] Expert Car Care – No credit or bad credit isn’t an issue now. You can get auto tires and repair services whenever needed with no credit. Pay off over 12 months of easy payments.

4] Alexander’s Full-Service Auto Repair – Approves up to 80% of applicants with an amount of up to $3000. This shop is dedicated to auto repairs. It only charges a $39 processing fee.

5] Element Wheels – Easy and affordable financing through Pay Tommorow on tires and wheels shopping. PayTommorow has soft credit checks that won’t affect your credit scores. You can pay with flexible payment options.

6] Pro-Wheel Sales – Shop for tires and wheels and get your automobile repaired with a lease-to-own facility. It approves up to $3000.

7] TreadWrightTires – It offers straightforward without a catch. No gimmicks like hidden fees. Pay for your products over 3, 6, or 12 months.

8] Viper Motorsports – Shop for car, truck & SUV tires, custom exhaust, bumpers, wheels, etc. with snap finance. They allow you to make small payments, and you can get approved for up to $3000.

How does Lease-To-Own Financing work?

People with bad credit or no credit obtain an opportunity to finance goods through lease-to-own financing. Snap Finance offers to purchase merchandise over 12 to 18 months of payments. So, how does it work?

Snap leased the merchandise they purchased. An additional cost is added to the leased product that is higher than the original price of the product. It could be double the original price of the goods.

For example – If you lease a product worth $600, you pay $40 every two weeks for 12 months. At the end of the payoff, you are paying close to $1000. It is more than double the actual price of the product.

Though Snap Finance doesn’t share any specific cost on their site, you can expect to pay this much. Also, a processing fee will be added when you make a transaction. The minimum lease amount is approximately $150.

However, the payment for your leased goods will be deducted automatically from your checking account. You’ll be paying overtime. After the terms of your agreement are fulfilled, you will own the goods.

Frequently Asked Questions

Final Thoughts

The whole thing should be clear to you now. There are countless snap finance stores, both online and local, where you can shop for your essentials. The process is straightforward and flexible.

However, one thing should be mentioned snap finance can be a bit expensive. There are alternative ways to get money, such as; borrowing from friends and family or selling unnecessary things.

But if you have no options left, we suggest considering Snap Finance. The cost shouldn’t be an issue when you get the opportunity to pay over time. If the situation is favorable, you should not have second thoughts but go ahead.