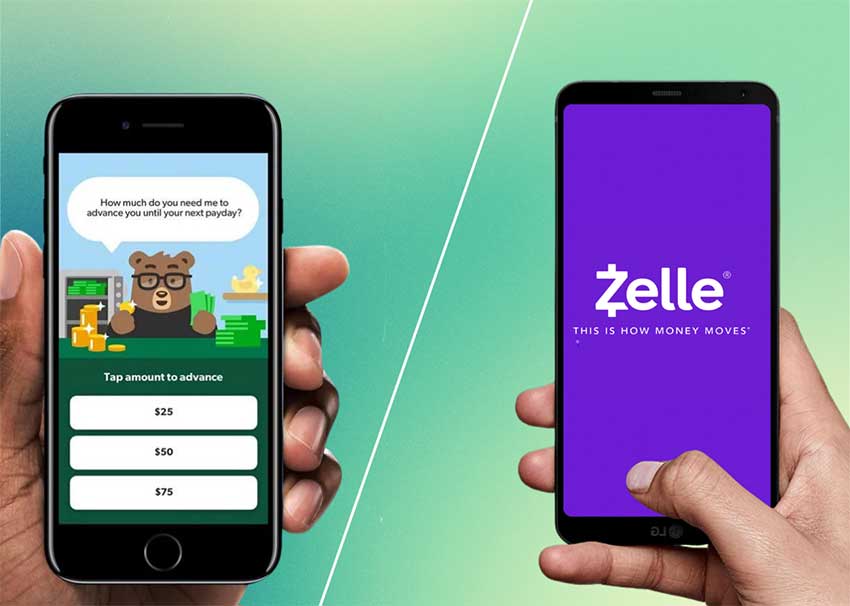

Does Dave Work with Zelle in 2023?

People use a lot of banking and mobile payments like Zelle and Dave these days. Zelle is a facility that people in the US use to move or transfer money from one bank account to another. On the other hand, Dave is not a traditional bank but a Fintech startup that provides checking accounts with Evolve Bank & Trust. When making purchases or sending/receiving funds, they are quick, safe, and easy to use.

If you use both Zelle and Dave, you might wonder whether these two apps can be used together. Can Zelle be used to move money into and out of Dave, or does Dave work with Zelle?

Here, I’ll help you in any way I can.

About Dave: What is Dave?

Dave is widely recognized as one of the top fee-free cash advance applications; Shark Tank’s Mark Cuban even backed it in its initial stages. The popular cash advance option allows you to withdraw up to $250 without paying any fees or interest, and you can make early deposits within 2 days.1

Not all Wallet functions will work with the Dave Card, and it won’t be accepted everywhere. Dave Cards can be added or removed from wallets with little effort. It does not cost anything more to add a Dave Card to something like a Wallet or use a Dave Card already there.

What is Zelle?

Zelle is just a payment system that enables the safe and speedy transfer of funds between bank accounts. These dealings take just a few minutes on average, and there are no fees associated with sending or receiving funds on the site. As of 2021, Zelle has 1.8 billion active users who have sent $490 billion in transactions to approximately 3,000 financial institutions.2

Zelle speeds up payments among US bank accounts using the Automated Clearing House (ACH) payment system. It can take three business days to complete an ACH payment. You begin from a bank account to a friend’s bank account.

Does Dave Work with Zelle?

Dave does not use Zelle, and its bank, Evolve Bank & Trust, is not part of the Zelle Network. Even if a user’s bank isn’t part of the Zelle network, they still have the option to use the Zelle app.

After looking for the bank in Zelle, choose “Don’t see your bank” to add the bank’s debit card. Immediate transfers are a huge convenience, allowing many customers to use Zelle without having to give Zelle access to their banking information. Immediate transfers via Zelle or the Cash App are not yet supported by Dave, even if you connect your Dave debit card to Zelle.

Follow these steps to use Zelle with Dave Bank:

1] First, get the Zelle app and put it on your phone. Then, start using it. Make sure you’re using the most recent version of the app.

2] Use the US phone number to set up your Zelle account.

3] Check out the Terms of Service and agree to them if they don’t bother you.

4] You’ll be sent to a page where you can look for your bank. You could search by typing “Dave,” but Zelle doesn’t work with Dave Bank so you won’t find it. But don’t worry; you’ll be able to add it with the “Don’t See Bank” option. So choose this one.

5] Now, to move on, you have to input your email address. Please enter the email address users want to use when they use Zelle.

6] Next, you should be asked for information about your debit card. Enter Dave’s debit card information, like the card details and ZIP code.

If your registration is successful, your Dave bank account will be linked with your US mobile phone number or email address. As long as you have a mobile number on file with Zelle, you can receive and send funds from other Zelle users. You can use a small amount to see if the transfer works. Dave can’t be used with Zelle’s immediate transfer.

Other ways to instant transfer money to David Bank Account (Without Zelle)

Even if you don’t use Zelle, you can still take Money out of your Dave Bank account. In its place, consider the following alternatives:

1. Pay with Apple Pay or G Pay

By connecting your Dave Debit Card with the Apple Pay or Google Pay app, you’ll have fast access to the funds in your Apple Cash or Google Pay account, which you can use to make purchases using your Dave Debit Card. Apple Pay fees a 1.5% fee (minimum $0.25, maximum $15) for instant transfers. Before adding the Dave Debit Card to Apple Pay or Google Pay, you must verify the debit card for a small fee.

Transfer funds from your Apple Pay balance to your Dave Card:

1] Enter the Wallet app, tap on the Apple Cash card, and click the More button.

2] Tap “Transfer to Bank” next.

3] Enter a number and then tap Next.

4] Tap “Instant Transfer” next.

5] To add the Dave Debit Card, tap “Add Card” and follow the instructions on-screen.

6] This will ask visitors to verify, so follow the instructions on the screen to do so.

7] Choose the Dave bank card (once added)

2. Putting Cash Down at a Store

You can immediately add cash to the Dave Spending account at any Green Dot location, like Rite-Aid, Dollar General, etc. Launch the Dave App on your mobile device, go to the Move Money section, and then choose Find ATM & money transfer locations to see a map of the closest establishments accepting cash deposits or withdrawals.

3. Use a mobile Check Deposit to Deposit Money.

You can also use Ingo Money Services on the Dave App to deposit a check from your phone. To deposit a check into the Dave Spending account:

1] Tap Add Money in the Move Money section of the app.

2] Cash a check 3 times.

3] Take a picture of the front and back of the check, and when asked, type in the amount. You can choose a free deposit that takes up to 10 days to be credited, or you can pay a small fee to make an instant deposit.

4. External Bank Account ACH Transfer

Your outside bank account can be linked to the Dave Spending account through ACH for easy and quick transfers. You would need Dave’s routing and account numbers to do this. Dave’s website says this transfer takes time and, therefore, can take up to 5 business days.

5. Using Direct Deposit

Direct deposit is a method through which employees get their wages without having to go to their employers physically. If your employer uses ADP, Gusto, or GoDirect as a payroll service, you can tap a link in the Dave app to go straight to the page for your direct deposit.

Dave Alternative Banks that offer Zelle

Zelle is being used by more and more banks every day. According to Zelle, its payment network will include approximately 10,000 financial institutions in the United States by 2021. Zelle is available at a wide range of banks, from small local and online banks to big national banks to branches all over the country.

1. Varo

If you’re searching for a different bank that works with Zelle, check out Varo since it has its cash advance service. Cash advance services are available through Varo, comparable to Dave’s, but with stricter qualifying conditions. To use the Varo Advance service, your account should be at least 30 days old. To use a Varo debit card, the client must have deposited at least $1,000 into their Varo bank account in the preceding 30 days.

2. Chime

Chime is Zelle compatible. However, there is currently no way to transmit funds straight from Zelle to Chime. For the time being, Zelle could only be utilized at brick-and-mortar financial institutions. Chime is a digital bank, and as such, Zelle does not yet support it out of the box. However, there is an answer to this dilemma. SpotMe, Chime’s overdraft solution, is available to consumers at no extra cost. SpotMe has a minimum payout of $20 but may go as high as $200 when a user has met certain account history and activity requirements.

3. Ally

Ally has been at the forefront of the financial services business for 80 years, providing consumers with expert guidance on how to save money and manage their finances. Using this bank’s new Zelle peer-to-peer money transfer service, you can send money to almost any bank account in the United States. Linking an eligible Ally Bank checking account to an Ally Bank Money Manager is free, and it allows Ally Bank clients to manage their Money on the move using one of the most intuitive applications.

Conclusion

What should we learn from this? There’s always a different way to solve a problem. Zelle is a suitable technique to send money quickly, and Dave should get affiliated with it. You can look into other ways to make an instant deposit into your Dave checking account or think about other banks that work well with Zelle.

But most of the time, people should only use applications like Dave to get cash advances if they have to. That’s everything for today.