What is Chime Bank Name and Address for Direct Deposit?

Chime is a financial service company that aims to assist people looking for a lucky break at banking. Because this service offers an alternative to existing banks, and by using it, your payday can be two days earlier. Interestingly, your employer isn’t required to mail you a check.

However, have you ever tried to make a direct deposit to chime from your bank? If not, you will get the chime bank name and Address for direct deposit in this post.

What type of Bank is Chime?

Despite popular belief, Chime is not a conventional commercial bank. It is a financial technology company that works with financial organizations and other banks to provide you with FDIC insurance and bank accounts.

In addition, Chime financial technology company operates with two banking partners- The Stride Bank N.A.( 324 W Broadway Avenue in Enid, OK 73701) and The Bancorp Bank ( 6100 S Old Village Place in Sioux Falls, SD 57108). However, the headquarter of Chime is located in San Francisco, California.

Where can I find my Chime Bank name and Address?

It’s very easy to find your Chime account’s bank name.

- Just tap and open the Chime app.

- And go to Settings.

- Under the “Account Policies & Terms,” you’ll see the chime Bank name and address.

Chime works with multiple banks. So. you must know which bank your account is connected with. And for this, you have to check the agreement of your account for the bank’s name or examine the reverse side of your Chime debit card.

However, if you don’t find it, you can call the Chime customer care service (+1 (844) 244-6363) or mail them at [email protected]. Interestingly, their customer support is available 24/7.

What is Chime Bank Name and Address for Direct Deposit?

When you have acknowledged the banking partner connected with the Chime account using the method outlined above, you can utilize the Chime Bank Name and Address as provided below:

The Bancorp Bank: The Bancorp bank is situated in Sioux Falls city, and the state name is South Dakota. In addition, the state’s Zip code is 57108, and its exact location is 6100 S Old Village Place in Sioux Falls, SD 57108).

The Stride Bank N.A: You will find this bank in Enid city, and the state is Oklahoma. Moreover, the Zip code of this is Stride Bank N. A is 324 W Broadway Avenue in Enid, OK 73701.

| Stride Bank N.A. | The Bancorp Bank |

|---|---|

| 324 W Broadway Ave | 6100 S Old Village Pl |

| Enid, OK 73701 | Sioux Falls, SD 57108 |

Chime Direct Deposit Form: How can I download it?

With Chim Bank, you will get a ready-made direct deposit form which includes your Chime account number, Chime routing number, and a Voided Check for your account. After downloading it, you can share it with your payroll provider or employer.

So, to download the Chime Direct Deposit form, you have to perform the steps below:

- After opening the Chime Application, select “Move Money.”

- Then, you have to choose again “Move your Direct Deposit.”

- The last step is to tap the “Email me my completed form” option, and your form is ready to be downloaded.

You can send the mail to your employer or print the form and submit it to your provider.

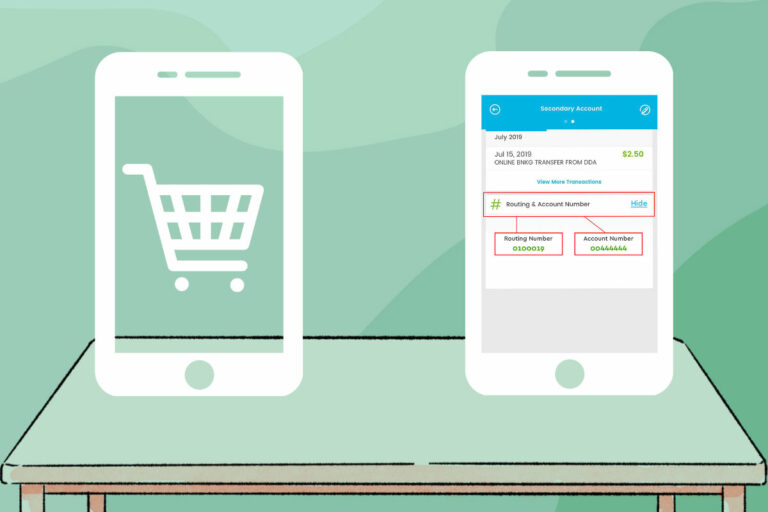

What is the process of finding the Chime Routing Number?

You can easily find the information related to Chime direct deposit, like your Chime routing number. To begin,

- Sign in to your account via the Chime website or mobile app.

- Afterward, under the “Move Money” option, you will find “Direct Deposit” and select it.

- There you will find your Chime Routing Number.

- Moreover, you will also get your bank name and account number that gives services related to Chime Banking.

Now, let’s discuss the details of Direct Deposit:

What is the meaning of Direct Deposit?

Direct deposit is a method of receiving your paycheck or payment electronically from one bank to another. The funds are transferred electronically to your saving or checking account. Therefore, you don’t need to follow regular banking financial transactions or visit a bank.

Moreover, there is no monthly fee, and most employers provide a direct deposit as a payment option. So, this is very simple to use. In the United States, direct deposit is currently used by more than 94% of workers.

What are the advantages of Direct Deposit?

By using Direct Deposit, you will enjoy numerous advantages, including additional security and faster access to money. Moreover, you won’t need to waste time visiting an ATM or local bank. Are you feeling interested to know more? Well, let me describe below:

- Direct deposit is convenient:

- With it, you will never have to fear losing a paper check again! A direct deposit account places funds into your bank account. In addition, log into your online bank account if it becomes necessary to view or print a copy of the deposited check. Moreover, your direct deposit will pop up on your monthly report, like all financial transactions. You must log in to your online banking app account and check the “recent activity” section. Even if you are not in the office, an electronic Deposit guarantees you are being paid at the right time.

- It saves precious time:

- You won’t need to pick up a physical paycheck and stand in line to deposit it at a bank or ATM. Direct deposit makes it simple and time-saving; log into your online credit union account or bank to ensure your paycheck has been deposited. Do you want to know the best part of it? You won’t need to wait and will have immediate access to your funds.

- It’s utterly safe than paper checks:

- Automated Clearing House ( ACH) provides greater security than a physical paycheck. When a digital check is deposited automatically every week or every month, there is no risk of it being stolen, lost, or even forgotten. Moreover, this safeguards the account information of your employer and your financial data.

- It provides a better and more convenient method of budgeting:

- You may be wondering how. Your monthly expenses, like your gas or electricity bill, mobile phone bill, or college loan fee, will be deducted as soon as your paycheck reaches your bank account. In addition, you will get the opportunity to have your money deposited into your savings account on a specific day of each month, which makes it less enticing to spend when you are attempting to save.

So, you can see that direct deposits with Chime provide many facilities. But do you know “How to set up a direct deposit with Chime? If your answer is no, check out the below section to have a clear idea about it:

How can I set Direct Deposit?

By using the Chime website or Chime application, you can set up a direct Deposit. So, let’s find out how to set it up:

Setting up direct deposit through the Chime website:

- If you are considering setting up a direct Deposit through the Chime website, you have to go to the website

- Sign in to your account.

- Then you will find an option “Move money” or “Print or Download.” You must click the option to get a completed deposit form.

- After clicking “Move Money,” you will notice the Chime routing and account number, which you can provide to your salary or benefits supplier.

Setting up direct Deposit through Chime Application:

- To set up a direct deposit through the Chime application, you have to follow specific steps;

- You have to open the Chime mobile application,

- Then select the “Move Money” option.

- Afterward, tap on “Move your direct deposit,” and you will get the “Find Employer” option under the “Have Chime do it for you.”

- Now, you need to provide some information like the name of the payroll provider, employer, Govt. benefits provider, etc.

- Then sign in and select “Continue” to automatically set up a direct Deposit.

Now, you can easily accomplish your direct deposit with your payer, employer, or benefits provider.

When Does Chime Direct Deposit Go Live?

It would be excellent to know the precise time of the day your direct Chime Deposit arrives in your account, right? Unfortunately, there is no fixed schedule. However, it ensures that your direct payroll deposits will go live in your account by 9:00 A.M ( EST) on your scheduled payday.

However, let me tell you one thing when your funds arrive at Chime, you will have instant access to your money. Because Chime never holds your funds. So, Your funds could be accessible at any moment. For instance, your direct deposit may show up in the morning, afternoon, or night.

Transfer Money from Chime To Bank: Process and Duration

If you are thinking about transferring money from Chime to a Bank account, you have to perform the below steps:

- Firstly, you must link your existing bank account to your Chime spending account,

- Open your Cime app, and log in.

- Afterward, open the settings and select the option named “Link a Bank Account.”

- Then select the bank name from Chime’s available bank list and provide login credentials to verify your identity.

- Secondly, you have to select the “Transfer funds” option. Then provide the money amount your want to transfer.

- Thirdly, select the bank from which you want to transfer money; if you didn’t link any bank account to Chime, then you can choose the Spending account option.

- Finally, tap the transfer button after entering the transfer amount and bank address. Then a review page will come and ask for a review. You can review it again and tap to confirm the transfer.

Generally, the transfer through Chime is accomplished in 3 days ( Business days) using ACH ( Automated Clearing House). Besides, the money is available for you to pull out within 24hrs.

How Do I Get More Chime Features?

Chime is more than checking and saving an account or a visa debit card. You will get SpotMe ( A fee-free overdraft) that allows you to “spot” up to 200 dollars. You will also get the opportunity to send boosts to your friends to help them reach their limits of SpotMe. Moreover, through Chime Credit Builder, they will provide you with a Chime Credit Card, and by using it, you can pay bills or shop. Interestingly, suppose you successfully repay your credit card bills. In that case, Chime will report to major credit builder bureaus, and it will help to make up your credit score.

Final Words

Getting direct deposits is a piece of cake with Chime. Unlike most banks, such as PNC, Wells Fargo, Chase, and Navy Federal Credit Union, you will not be charged any additional fees. In addition, you will receive your money two days earlier.

As mentioned earlier, opening a direct deposit at Chime is similar to creating a traditional Bank account; you must have your commercial bank account, routing number, and employer’s signature on the direct deposit form. So, you can see how simple it is to create a direct deposit at Chime, and now you have the Chime bank name and Address. So, set up a direct deposit at Chime bank and enjoy the facilities. Thanks for reading.

![Can you Combine Visa Gift Cards? [Answered] 8 Can you Combine Visa Gift Cards? [Answered]](https://etransfermoney.com/wp-content/uploads/2022/10/Can-I-combine-visa-gift-cards.jpg)